The Worldview Schism Fueling The Tech-Media Wars & Stunting Our Growth

There’s a quiet worldview schism among today’s American elite, one I often shorthand as “New York” vs. “San Francisco” among my friends. But this schism is more fundamental than a mere city difference, and almost every part of our mainstream discourse is downstream of it.

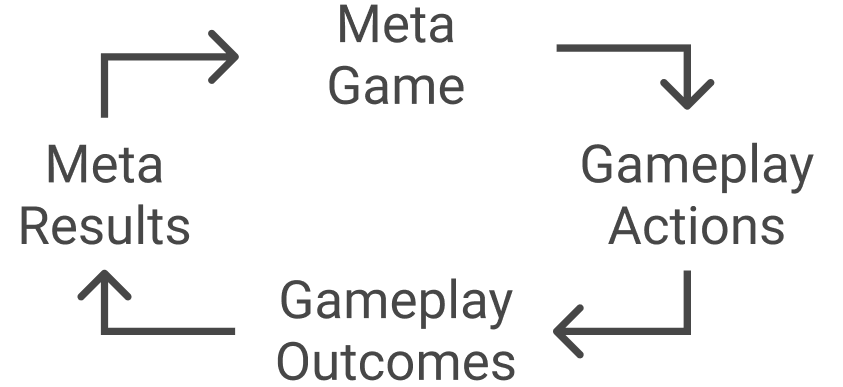

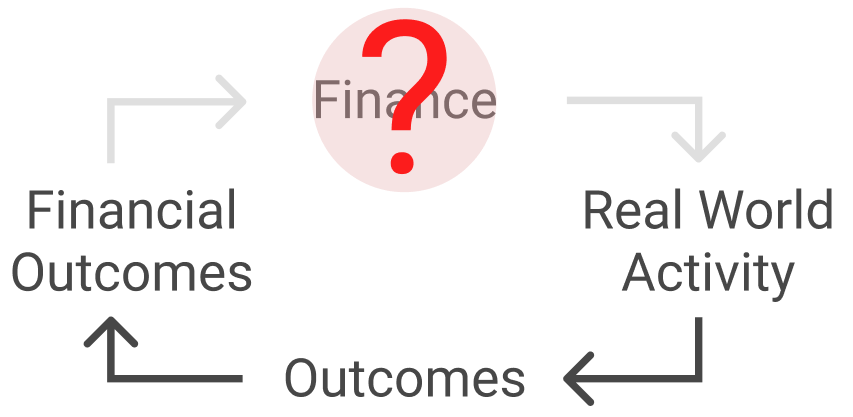

Does Finance drive the world, or does the world drive Finance?

Elite Underproduction — a short summary:

The schism concerns the primacy of Finance in determining causation of real-world outcomes

New York Schoolers assume Financial causation of all real-world outcomes

San Francisco Schoolers assume an unmodelable variety of real-world factors cause all Financial outcomes

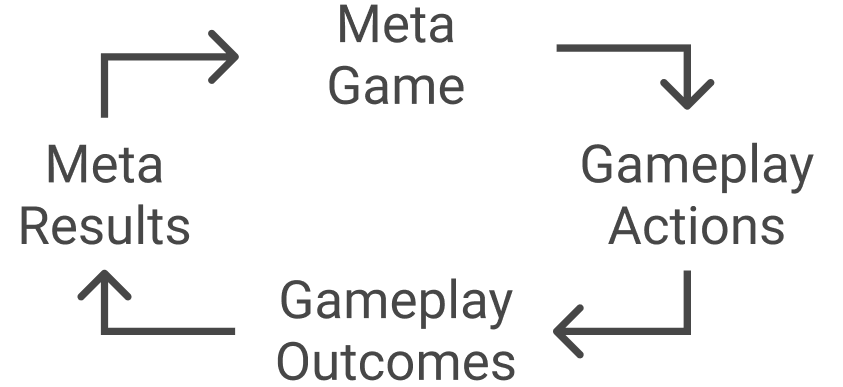

The reality is that both perspectives exist as part of our societal “Creation Loop”:

The New York School makes the world legible & so dominates Finance, Academia, Government, and Media

It lets you model complex phenomena & predict outcomes. When it works, it helps you understand & direct the flows of capital that help build…everything

Where it fails is by relying too much on abstracted models, leaving individuals confused & uncertain if they come too close to genuine building processes

The San Francisco School provides a framework to actually build real-world projects

It lets you deconstruct & reconstruct systems of any complexity level, and its entire methodology is “begin by doing”

Where it goes off the rails is by assuming that a (metaphorical) screwdriver can fix any problem — and that there are no consequences for ignorance of the laws of Finance

A primary role of “the elite” in any society is distilling & packaging complex phenomena into digestible Narratives for the public

Today, our Elite is heavily siloed between these two schools. There is minimal cross-pollination between the two

They war frequently on Twitter & across the frontpage of major publications, but rarely develop any understanding of “the other” perspective

As a result, the Narratives for our biggest problems end up being flimsy 2-D cutouts, not (exclusively) due to malice or incompetence, but because our biggest problems involve every facet of the societal Creation Loop — by definition, understanding them requires a multi-perspective appreciation for the complexity of the situation

Actually solving them requires the work of both Schools…but only a handful of individuals are able to bridge that gap today

The “Underproduction” referenced in the title — Elite Underproduction — is not primarily an underproduction of Elites, it’s an underproduction by Elites of the sorts of fully-fleshed-out Narratives that would help us solve our biggest problems

Given that the majority of today’s American Elite exist primarily in one school or another, and that building a compelling Narrative that incorporates both New York and San Francisco School truths is a tall order, it might be that the only way to resolve the underproduction of Narrative is by producing more Elites, of a new phenotype, who can mend the schism…

…But with the democratization of messaging, it’s also possible that the schism can never truly be mended

In the meantime, the primary takeaway for individuals is to be wary of anyone presenting a complete Cause → Effect model that only incorporates a single School’s worldview

And to note that the relationship between Finance and Real World Activity is just one example of a higher-level loop:

The Twin Schools

In short: To be a member of the New York School is to assume Financial causation of real-world outcomes. Finance becomes the default hypothesis for ~everything:

New York / Yankees-Dumbledore

To be a member of the San Francisco School is to assume real-world inputs cause all Financial-world outcomes. All Financial outcomes are assumed to be the result of a near-infinite variety of unmodelable actions:

San Francisco / Warriors-Tony Stark

The answer is of course that both worldviews are true — the causation goes both ways, and is an example of endogeneity/reverse causation/simultaneity, known in Silicon Valley as “loops”.

I call this one the Creation Loop:

Here, “Finance” refers to society’s background financial situation as well as any specific initial financing provided, “Real World Activity” refers to the undertaking of production or consumption, “Outcomes” refers to products & services created or consumed, and “Financial Outcomes” refers to any positive or negative [Dollar] values associated with those real-world outcomes.

With a New York School mindset, you could imagine walking through this loop in Tech today like so: [Seed Funding Round] → [Engineering & Design work] → [A Product You Can Go To Market With] → [Revenue Growth At Your Company] → [Another Funding Round] → & so on.

Counterintuitively, understanding this loop above actually leads to more in-school bias than already existed: anyone predisposed to assume Financial causation will look at the loop above and realize that if they focus all their efforts on the “Finance” part of the loop, the rest should take care of itself.

Thus, New York School members tend to perceive reality like so:

“If we solve initial financing considerations, the rest will take care of itself”

In contrast, San Francisco Schoolers see this:

“If we build the best product, we’ll all get rich”

The real problem with loops is not how powerful they are, or how common they are, or even that people are oblivious to their existence.

The real problem with loops is that educated decision makers know how powerful they are.

Truly knowing about loops can let you lie to yourself about where best to spend your efforts. And decision makers lying to themselves is how everyone ends up in trouble.

No loop can withstand the efforts of a motivated true believer forever.

The New York School: Writing The Whole World Down

The New York School has one huge advantage: legibility.

At the undergraduate level, Finance presents a suite of understandable input-output relationships that can be measured and predicted. At the post-graduate level (and here I humbly include real-world corporate experience), things become more complex, relationships more tangled, the math more dense — but even here, quantization is technically possible.

If you want to be able to reason about the future, you need a map/model of some sort. The New York School provides that map. It is thus most popular in domains that have a pressing need to produce a model of some sort: Finance, Government, and Academia.

By my “city-based” analogy, that would be New York, D.C., and Boston.

Legibility also allows for easier communication, making the New York School popular among people who write about what is happening in the world for a mass audience.

Pictured: New York School Starter Pack

Accurate modeling of the future is a necessary skillset for any person or institution that wants to survive, and the burden of leadership in all domains necessitates making hard allocation choices with finite resources — which means someone has to be modeling the future.

If it’s not you or someone on your team, expect to lose to a competitor with a more accurate model of the world. As Andrew Carnegie put it:

Andrew Carnegie’s autobiography, shoutout Jason Crawford for sharing this tidbit

In short, the New York School gives you the tools to understand and direct flows of capital in order to help stuff get made.

Downside of The New York School

The downside of the New York School is that it inculcates an abstracted view of reality, and the more mastery you gain over the tools & methods of Finance the more you rely on them to make sense of the world, and the further away you become from the underlying reality.

Many of the best and brightest minds from America’s elite move to working in the New York School immediately after college. I don’t say that sarcastically — I mean people with much higher SAT scores than the average internet reader, who have passed all the tests sent their way with ease.

This is perfectly rational on their part, as the American economic model is in many ways predicated on the strength of its financial system, and positioning yourself close to the primary driver of Wealth creation in any system is a great way to capture some of that Wealth for yourself:

Read here for more on what this chart shows & what it means to be able to consume more than you produce — obviously this is a very different but very interesting topic!

But when you spend your whole academic life operating in a world of abstractions & models, and then you move immediately to an adult career building or communicating even more abstractions & models, it can be hard to develop a coherent sense of what’s actually going on in the world.

I’ve been there. It’s a strange place to end up in. You can describe what a thing is and build a fancy excel model of its future, but if you had to grab a wrench & tweak it yourself you wouldn’t know where to start. Your explanations are all neat and compelling, but listeners find something just a little hollow about them. Your descriptions use all the right terms, but if someone taboo’d enough jargon-words you’d stumble into an awkward, mumbling silence. You’re more afraid of that silence than anything else, even losing money, and you try very hard to pretend you know something, anything to fill any potential pause that might be interpreted as that silence.

You know the names of many things, but still lack…something. Many bright teenagers find themselves in this position, simply because their intellect has only ever been applied while sat in a chair, pen in hand, reciting a teacher’s password.

In my previous essay on methods of increasing societal-wealth, I connected Wealth-generation via Finance to magic, and specifically to Harry Potter magic. Harry Potter magic is wonderful because it’s: predominantly static, well-defined, knowable, teachable, primarily built of esoteric incantations, and relatively egalitarian (so long as you have the right alma mater bloodline).

This description also applies to the Financial world.

Whether you’re reading the Wall Street Journal or at a houseparty in Manhattan with investment bankers, the precise sequence of spells being cast around you will be warmly familiar. As with Harry Potter, the person casting the spell does not need an understanding of the exact mechanism by which the incantation results in a magical outcome. It matters not, the outcome happens regardless.[0]

While some of my finance friends might be offended at this thin depiction, I hope they can understand my point, which is that mastery of the mechanisms of Finance does not necessarily confer mastery of the underlying mechanisms of business, and indeed it is not necessary to ever master the underlying business mechanisms to become Wealthy & successful.

It’s possible to exist entirely within this wizarding world.

Really, it doesn’t sound so bad — and it’s not. Early in my career in Tech I received quite a few phone calls from young investment bankers interested in switching “Schools” and moving out West. Mostly, I convinced them to stay in New York by highlighting the negative-expected-value trade they were considering. My position was that those convinced by this argument belonged in the Finance world by default, while those who challenged the outcome I presented while still accepting the premise that “expected-value” was the best way to make career decisions would also find more happiness in Finance.

The New York School’s primary downside is simply the confusion and irritation that all wizards feel if they are ever forced to leave the comfortable world of abstractions and interact with the nitty-gritty world of grease and tolerance. It’s a small downside, really, relative to the potential gains. I encourage readers to become wizards.

Pictured: The Product Creation Process as seen by The New York School

But this is a real downside. It has real implications for creativity, self-confidence, security, and the willingness for an individual to roll up their sleeves and just get started.

The San Francisco School: Engineers Engineer Engines

In contrast, the San Francisco School has basically nothing going for it and many downsides.

Rule #1: Everything begins in the green circle. There are no other rules. Begin by doing.

The San Francisco School makes communication more complex by requiring participants to have a near-infinitely-deep understanding of both the micro- and macro- dimensions of any problem space they want to discuss.

All problems must be both specified and contextualized.

It does not allow for particularly granular forecasting and so is of limited use to people whose careers depend on making good forecasts 9 times out of 10 — which, in a complex modern economy, describes most people in positions of authority.

Its effects are hard to measure, making it more painful for democratic forms of leadership that like to actually earn their votes. With so many moving parts, proper attribution — and therefore a proper understanding of causation — becomes nearly impossible.

And its main applications of value in Academia are historical ones. While that might seem insignificant, it has relevance to how the ideas spread: ideas that do not suggest any course of action to those with political or economic power tend to take much longer to proliferate, particularly if they’re hard to encapsulate in a single paper.[1]

With the deck stacked like this, it’s a wonder the San Francisco School has any members at all.

There’s only one reason people join: it helps you make stuff. Emphasis on you.

Pictured: San Francisco School Starter Pack

The San Francisco School teaches that, with a sufficiently deep or novel understanding of the micro- and macro- environments in a given domain, an individual or institution can effect meaningful change in the real-world via direct action, regardless of any initial Financing considerations.

And it encourages you to pursue that understanding yourself, with your own elbow grease.

All the downsides I mention above? None of those matter when it comes to actually sitting down and building something. Those “downsides” either happen before (forecasting) or after (measurement) the process of creation.

Making stuff is hard. Really hard. Anything that helps people make stuff is to be treasured and protected. If you don’t understand it, or if you wish to learn more about The San Francisco School, the only way to do so is through experience. You can’t do a report on it and come away with anything meaningful — to look at it from the outside is to miss the whole point.

Once you’ve joined The San Francisco School, outward changes in Financial metrics — at all levels, from the individual to the corporate to the national — are viewed as downstream from concrete real-world choices made and actions taken by specific humans and their teams. And how could it be any other way? After experiencing the arbitrarily chaotic mess of the early days of most successful endeavours, how frequently they lived or died on the skills and commitment of a handful of people, what other conclusion could there be?

If you feel like I’ve done a good job describing the San Francisco School here, then I’ve probably messed up. A proper understanding of it is only acquirable via direct action upon the world. Words alone cannot suffice.

Ignorance Ain’t Bliss: San Francisco Edition

Aside from all the downsides of illegibility mentioned above, there’s a deeper downside to the San Francisco School that makes itself known when members are confronted by the Financial realities of their world.

When muggles enter the wizarding world, so to speak.

Because the San Francisco School encourages its members to make stuff and to view external Financing conditions as a downstream consequence of successful-or-unsuccessful building, it explicitly avoids teaching anything that looks like Financial Wizardry.[2]

Regrettably, the real world is subject to Financing considerations. You can’t just “build” your way out of some problems without considering the financial background around the problem space.

If you don’t appreciate the myriad ways that Finance can control your outcomes — seemingly existing outside your “black box” and still finding ways to influence either your inputs or your outputs — you’re going to have a frustrating confrontation with reality in the near future.

If the primary emotional reaction of the New York School when it fails is befuddlement, the emotional reaction of the San Francisco School when it breaks down is exactly that: frustration.

There are many possible branches for a frustrated person to go down, but there’s an underlying truth to the stereotype of a cynical veteran engineer:

A totally arbitrary hypothetical in which the background Financial situation undermines value creation for the builder. Read more here.

You can build a better product and get outspent on distribution. You can build more product but magically make less revenue. You can build product more efficiently but somehow your inputs are all now more expensive. You can build a brand new product and get offered a “deal”: accept our offer to purchase your IP for twenty cents on the dollar or we’ll spend seventy cents on the dollar to put you out of business. You can build & ship a better product to more customers and make more money, but a market correction revalues your business 40% lower, ruining your ability to fundraise & attract new talent, starting a downward spiral you can’t pull out of.

You can navigate all these hurdles and meta-engineer the institution itself to withstand these forces, only for someone senior to leave the team and take all your meta-engineering with them.

Maddening.

Sidebar: Dual Membership: Have Cake, Eat Cake

One theme of my writing has been to try and emphasize areas where the “correct” view to take on a given topic is a synthesis of both sides, or at least an appreciation for the other side.

It’s not really possible to study at both the New York School and the San Francisco school, at least not at the same time. But it is possible to learn how both schools approach problems, learn to spot which might be more effective in a given domain, and choose which stance to take based on the circumstances. It’s not a coincidence I chose a famous Industrialist like Carnegie to represent the New York School — nor that the 3 faces I put in the San Francisco School’s starter pack have all demonstrated mastery over financing conditions.

The strong version of this pitch looks like this:

The Zenn Diagram

Basically: enlightenment or something. The goal is not merely to acquire a diverse set of perspectives, the goal is to integrate them.

Elite Underproduction: The Cost of Unnoticed Schisms

The divide between these two major worldviews goes unnoticed and undiscussed in today’s elite discourse.

Specific events — from the corporate level to the national level and beyond — are usually analyzed by the elites at whichever School is closest to the outcomes of a given event. They then only notice causation-type events that align with their own school.

To be specific: if an event is first noticed via a Financial Outcome, it will be viewed as a Financial Event and subjected to analysis via the New York School. This trend is somewhat exaggerated by the fact that our ~entire analytic & media class is comprised of New York Schoolers.

Last year I wrote about an event that is widely considered to be a Financial Crisis, despite shocking Industrial contractions occurring immediately prior to said crisis, with clear and obvious causal factors at every possible level of a San Francisco School style analysis:

In such a scenario, it would be shocking not to see sharply negative Financial Outcomes! source

One push-back I got on this piece was (paraphrased):

This analysis is simply an artifact of measuring in a single currency (USD). If you adjust all the numbers for changes in exchange rates, or make them all per-capita, many of these apparent trends disappear.

Which is (somewhat) true and also (mostly) unhelpful.

What drives the exchange rates? What economic theory suggests that raw-population-count is the appropriate driver of growth? What puts pressure on the various exchange rate pegs? Some of my readers might be religious, but I tend not to believe Divine Intervention leads to changes in the relative value of economies:

If you’re trying to work out what happened in Asia circa 1997 and your answer doesn’t include a San Francisco School-style analysis of the massive changes in trade policy & trade behavior by the largest consumer of products on the global market…

Apologies for the tinfoil-hat diagramming here — this is my best attempt at laying out the current New York School mental model of what happened circa 1997 in Asia [3]

…I’d love to hear from you because I can’t make any sense of it.

Lest anyone think I’m unfairly targeting one school here, I also wrote last year about the archetypal overreach of the San Francisco School:

So on the one hand we have The New York School labeling an event as a Financial Crisis and analyzing it in the context of central bank actions & cronyism…despite clearly being precipitated by massive anti-Industrial pressures placed directly & indirectly on certain Asian nations by US trade policy-

-and on the other hand we have a strange Trumpian San Francisco School trying to spark an Industrial revival in the domestic United States without understanding any of the background Financial pressures that exist to counteract all of their efforts…and with no plan at all to mitigate them.[4]

I don’t want to go too deeply into the fallout of misdiagnosing these two events — it would take a whole book, and my essays are all longer than they should be already. If you’re curious still, and feeling somewhat cynical, consider the nature of the “Economic Reforms” that the IMF foisted onto certain Asian nations in response to their 90s crisis, all while China grew to dominate the region following none of those “reforms”. Try not to blame Western media for blaming cronyism & corruption in South-East Asian economies for their respective economic collapses instead of a realignment of American policy — nobody likes to look in the mirror that closely.

Or consider the cost to a nation of a Trumpian Trade War conducted alongside a completely misaligned Financial Policy:

“All the pain, none of the gains.” source

Shifting gears, another #HotTopic where the wrong School is commonly applied:

San Francisco Schoolers often believe Japan’s Housing Policies are responsible for the relatively-more attractive cost of housing in Tokyo vs. San Francisco, instead of the economic performance of the two cities being the Ur-Factor, as seen in the two charts below:

Period of declining Japanese residential property prices:

Coincides with a period of poor economic performance:

Please note the y-axis is plotted on a log scale. Red lines correspond to roughly the same time period

You might imagine a similar graph for San Francisco and FAANG stock circa 2013→2020? Some readers might already be familiar with RandomCriticalAnalysis’s work on US Health Care Costs, which is probably the best and most detailed research on the topic that exists anywhere. His conclusions should not surprise anyone who fully understands the point I’m making above regarding economic performance of a geographic region and real estate costs.

Policy is a powerful tool, and San Francisco has policies that discourage home-building, and Japan might have better policies for making housing affordable, but you can’t fight the tide. On its own merits, Japan lost a decade of economic growth. Relative to global superpowers, it lost 2-3 decades of growth. It’s a big deal. I’ve written about it directly & indirectly recently:

This sort of stuff has a large impact on real estate prices in your major Financial Center & primary city source

Most comparisons San Francisco schoolers make are flawed in exactly this way — a “just so” dataset that supports their preferred nitty-gritty policy implementation. In 1989 the land beneath Tokyo’s Imperial Palace was worth more than all the land in California combined, one should assume this was not the fault of Tokyo’s housing policy. Refer to the Nikkei 225 Index above for a good mental model of how that sort of thing happens…

Alas, the belief that policy — which translates in my model to “Real World Activity”, at least in the political sphere — is the primary determining factor of outcomes is the key failure mode of San Francisco Schoolers.

Takeaway: Elite (Narrative) Underproduction Is Upstream Of Bad Policy & A Stunted Discourse

You can’t solve problems you don’t understand.

Members of both Schools always believe they understand the world around them — that’s what it means to have a coherent worldview. But believing a thing doesn’t always make it so, and there’s much to learn from looking at events through a different lens.

I framed some of the examples above in a more biased way than the underlying reality, in order to underscore my point about the underdeveloped Narrative from the “other” School. In truth, the correct framing of the problem always incorporates both Schools’ perspectives.

Finance and its levers really do matter for every single problem of note. As does the infinite variety of policies & actions & personalities that define the San Francisco School view.

If you take away one thing from this essay, it should be this: distrust anyone who presents a single-independent-variable model of causation for meaningful events. If you care about achieving or altering outcomes, seek to understand both the New York and the San Francisco perspectives.

The real world is messy and it’s loops all the way down.

The “Elite Underproduction” I referenced in the title is not an underproduction of Elites, it’s an underproduction by Elites of fully-fleshed out composite narratives that describe Cause-and-Effect of complex phenomena. Which is basically their ~primary role in society.

I don’t have any grand plans for rectifying this gap. I try to minimize the amount of advocacy that creeps into these essays, and this problem seems monumentally difficult to solve. How do we increase the number of people capable of integrating opposing worldviews about something so fundamental as “the causation of progress”?

With sufficient specialization of labor, a schism like ours seems almost inevitable. If I were the sort of person who liked writing strident advocacy-type pieces, I might conclude that we need a new Elite — one formed from the intersection of both schools — requiring a complete rethinking of our current {Talented Youth} → {Hallmarked Institution A} → {Hallmarked Institution B} pipeline. But I’m not that sort of person, and the truth is I have no great ideas on this front. I’m not even sure it’s possible to do at scale.

The reality of the democratization of messaging is that a polarized public will amplify whichever message aligns with their own “school” and, at best, ignore anyone trying to bridge the divide.

So the best advocacy I can manage right now is a simple reminder not to over-index on the claims and Narratives of people who exist only within a single School.

The fundamental relationship between “Finance” and “Actions” that I’m trying to articulate in my synthesis here generalizes beyond this one specific instance. In my mental model, Finance is basically the metagame within our societal creation process:

The most condensed version of our problem is:

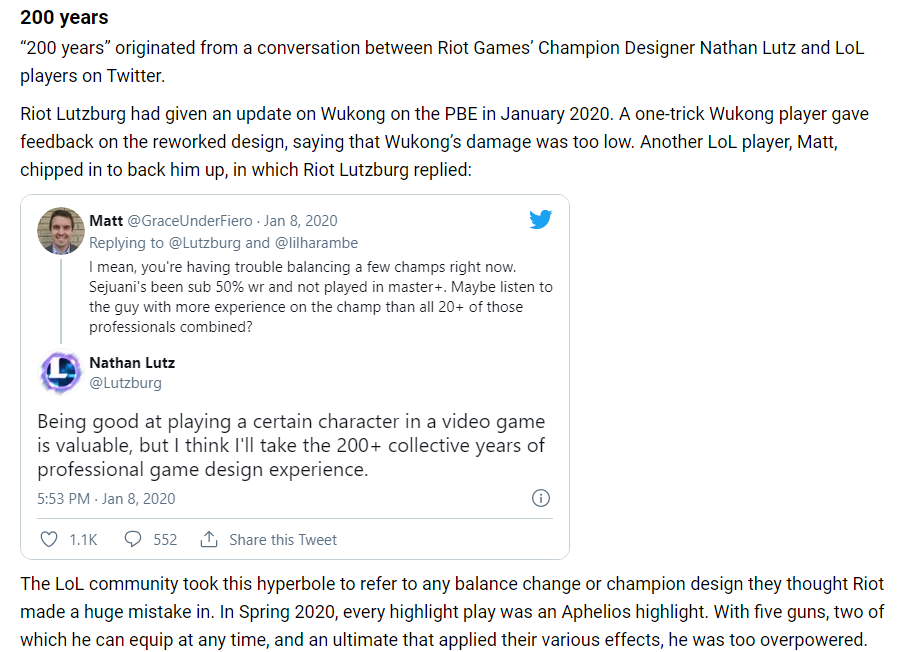

The people who shape and play our societal Meta Game are unfamiliar with actual Gameplay, while those who play the game itself are barely even aware that a Meta Game exists above them.[5]

And if you want your Narrative to spread, you have to align with one of those two groups of people.

Notes

[0] One amusing feature of the Harry Potter world is the stunning incompetence wizards display outside of the wizarding world, continually confounded by operating simple mechanisms. When I was younger and actually reading the books, I thought this was a silly limitation to explain why wizards didn’t just rule the world or something.

Now, it seems to have a deeper truth: someone whose every interaction with the external world involves speaking magic words they memorized in their youth would have a very different map of causality to someone who grew up in a world where…buttons activated things, switches closed circuits, and pistons drove engines.

(I swear, I don’t even like the series, but once you’ve committed to a metaphor…fantasy nerds would clearly know that this cataclysmic worldview schism is a much better parallel to Patrick Rothfuss’ divide between Knowers and Shapers. Alas, not all my readers are nerds and so here we are, referencing Harry Potter….........................)

[1] Jason Crawford’s personal study on The Roots of Progress is the quintessential San Francisco Schooler’s approach to academia. A series of deep-dives into the technologies and sociologies underpinning human progress across all domains — the potential length & breadth of his study is unbounded. As someone who likes real progress, I’m a fan.

Alexander Hamilton’s 1791 Report on the Subject of Manufactures has a similar approach. The Wikipedia summary of his report is 834 words long, which is more than most history textbooks devoted to the subject. The actual report itself is 48,000 words long if you include the copious notes provided. Summaries of the report are absolutely horrific, not because they are short, but because they remove the entirety of Hamilton’s nuanced thought & earnest wrestling with thorny problems in favor of awful language like “Hamilton reasoned X” or “Hamilton believed Y” or “Hamilton had 3 points”, like the man was arguing in some high school debate club instead of trying to unpack the multidimensional problem of bootstrapping a fucking national economy.

“Hamilton advocated more [X]” is like saying “the chief engineer advocated stronger engine internals”. Yes, sometimes you can make straight upgrades to an engine and gain more horsepower. But often there are tradeoffs to be made among multiple dimensions, and stronger materials might place more strain on other parts of the engine or add more weight to your machine or cause other parts to wear & break etc etc. Listen to more on this here. Or, if you work in tech, consider the pain of someone writing: “[CTO] advocates shipping more code, faster, with less bugs.”

The irony, that Hamilton, first secretary of the treasury, creator of the US Mint, and in many ways the founding figure of the US financial system, counts as a member of the “San Francisco School” does not go unnoticed.

But there’s a reason I chose “New York School” and “San Francisco School” instead of simply “Finance School” and “Engineering School” — it is both possible and reasonably common to live and work in Finance (and to a lesser extent Government, Media, & Academia) but operate with the San Francisco School’s mentality. Many of the most famous & successful investment professionals operate this way.

Likewise, it’s possible to live and work in “Operations” (i.e. engineering & any domains related to shipping & selling product, however loosely defined) but approach your problems with a New York School mentality. Many of the hardest problems are solved this way.

[2] The reason is likely because it’s very hard to teach people about magic without them wanting to become wizards (“you mean it’s basically a guaranteed path to leveraged wealth generation so long as I’m above-median performance?!”) — but also because there is some part of The New York School’s worldview that tends to inhibit its members. Inhibition does not mesh well with The San Francisco School’s methodology.

Once you learn about risk-adjustments, everything that isn’t Finance starts to look a bit worse.

The inhibition perhaps comes from the belief that Financial considerations determine ~all outcomes, and therefore any non-Financial activity is a waste of effort. The Efficient Market Hypothesis applied to all non-Finance activity.

Also, one part of “a map is not the territory” is that certain things will be easier to map than others. People who build models must first build “maps” of reality — representations of phenomena in their model — and they will tend to exclude things which are hard to observe / predict / model. Sadly, reality is chock full of the latter.

[3] Seen through this lens, US businesses complaining about NAFTA are sort of missing the forest for the trees here. You could absolutely adopt an Industrialist lens and view the loss of your domestic business to Chinese and Mexican business as a thing that happened to the detriment of your own ability to Capture economic value — but NAFTA didn’t cause that. It just shifted the person who was going to benefit from [Japan/Korea/SEAsia] to [China/Mexico]. The tide was against you long before NAFTA.

Maybe things accelerated afterwards, but “you made things that were trending against us move faster than they were otherwise doing” is much less compelling narrative.

[4] Yes, this Trump stuff still counts as San Francisco School despite how hilarious and awkward that naming convention becomes when applied to the 2016 Trump administration. If you’re doing Industrial Policy and trying to get people to make stuff, you’re operating at least partially in San Francisco School territory. Sorry, but it is quite funny…

[5] To extend the gaming metaphor to its obvious conclusion:

The game developers, coaches, pro team managers, and journalists have 200+ years of collective experience, but have never even queued for a ranked match and experience ranked anxiety at the thought of it — while the actual players aren’t even aware that the choices they make are constrained by the decisions of the aforementioned developers, coaches, managers, and journalists.

The two groups get very upset at each other for the problems they can identify, but no progress will ever get made while the people at the pinnacle of both groups completely misunderstand each other.

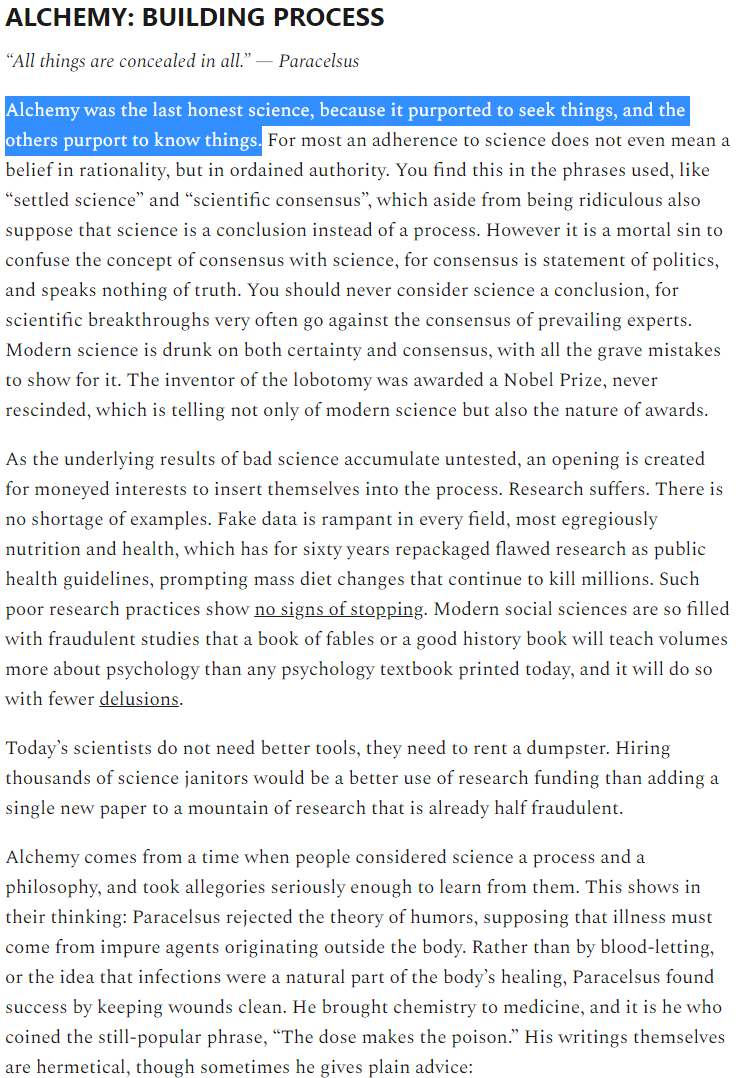

[99] Various Associated Readings and Such

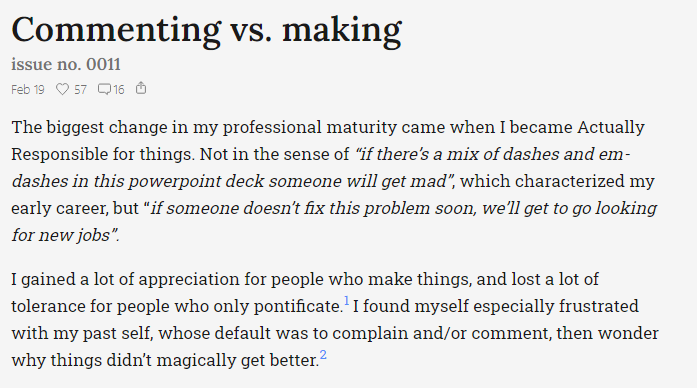

Commenting vs. Making by Chief of Stuff aka Karl Yang

From Byrne Hobart’s newsletter.

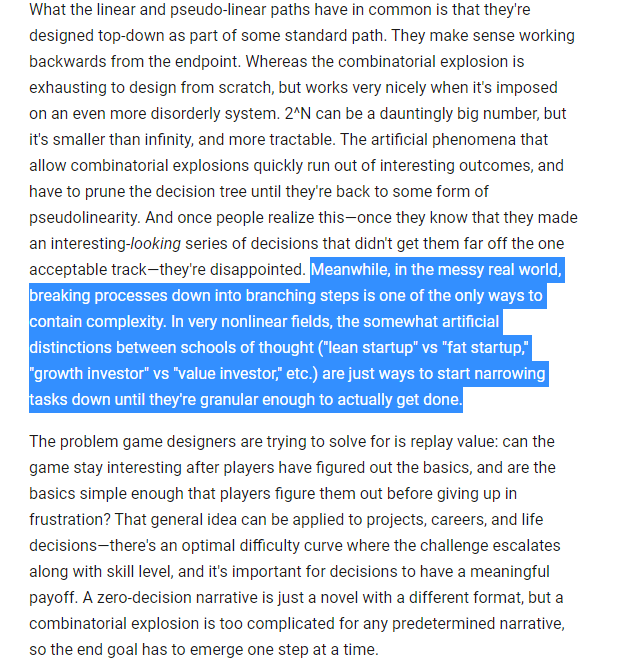

The highlighted part is very true, very relevant, and also a very meta-way to think about exactly what I was writing about here. It’s not a coincidence that many of the most successful “San Francisco Schoolers” have a deep understanding of the “New York School” — and vice versa. These distinctions are all just ways or narrowing down fractal complexity into something you can talk about.

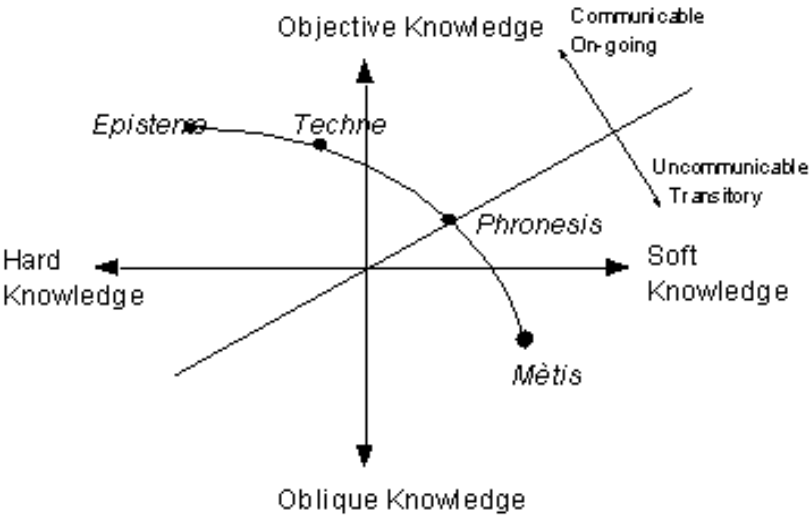

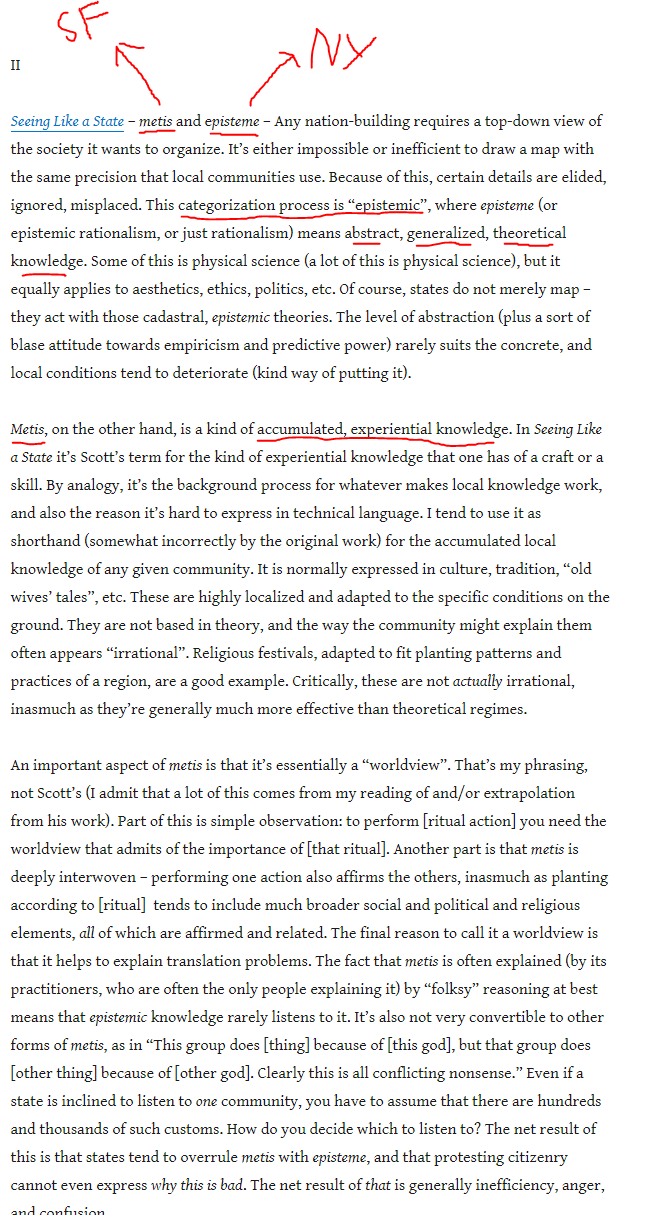

“Attempts to position metis, phronesis, techne and episteme” from Baumard 1994 Baumard’s diagram which represented the four Greek forms of knowledge along two continua… source

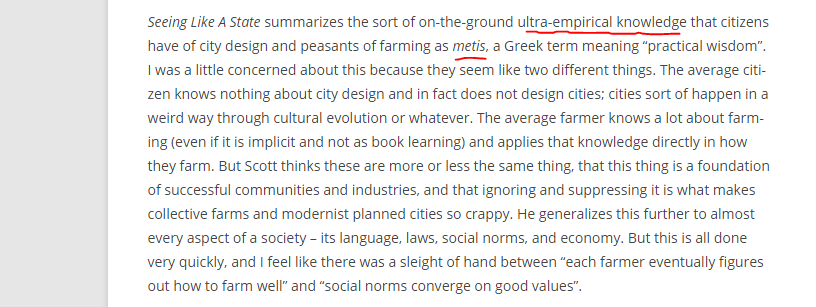

Book Review: Seeing Like A State by Scott Alexander

The Uruk Machine, by samzdat

- The Schism: Two Schools

- The New York School: Writing The Whole World Down

- Downside of The New York School

- The San Francisco School: Engineers Engineer Engines

- Ignorance Ain’t Bliss: San Francisco Edition

- Sidebar: Dual Membership: Have Cake, Eat Cake

- Elite Underproduction: The Cost of Unnoticed Schisms

- Takeaway: Elite (Narrative) Underproduction Is Upstream Of Bad Policy & A Stunted Discourse

- Notes & Related Reading

![Apologies for the tinfoil-hat diagramming here — this is my best attempt at laying out the current New York School mental model of what happened circa 1997 in Asia [3]](https://images.squarespace-cdn.com/content/v1/5a571a7d80bd5e91de77e8e6/1619907864038-GR4U1VXG7DCJKEZQ4F5E/asian_crisis_new_york.png)