Why You Should Play Games To Excess

This week[0], Xi Jinping’s government announced it was banning videogames — the latest salvo in a slew of attacks aimed at bringing China’s tech giants to heel and keeping the nation’s future tightly aligned with the CCP’s industrialist vision.

I have no further commentary on that national vision. I wish them good luck.

But in the dark days to come, when millions of Chinese youths will be forced to borrow ID cards from parents and grandparents, I do have some commentary about the videogames themselves.

For those who aren’t familiar with the landscape of today’s Discourse on Gaming, played out across Twitter, blogs, & old-media thinkpieces, the positions are approximately:

“Games are a primary means of experiencing reality & playing or building them is an aspirational life goal.”

“Games are fun!”

“Gaming is an awesome way to escape the struggles & mundanity of regular life and indulge in infinitely varied simulations of an alternate reality.”

“Games are fun, in moderation.”

“Gaming is designed by sophisticated college-educated developers to exploit psychological quirks, such as random rewards, and addictive tendencies among the masses — at their worst, no different from hard drugs, at their best a colossal hedonistic waste of energy.”

“The kids are spending too much time on games!”

“Even in moderation, time spent gaming is time mentally obliterated beneath the weight of repeated routines, each iteration of a gameplay loop merging into the prior one in the gamer’s memory. Even doing drugs is less antisocial than gaming.”

Those positions are actually all pretty reasonable, you just have to understand the different real or imaginary subject “Gamer” that each one applies to.

But I’d like to add one more position, one not expressed very much:

Games are best played to excess in order to learn things you won’t learn in school or early in your career

Categories of Gaming

Not all games are alike.

There are games you play by yourself, an interactive entertainment experience.

There are games you play with friends, for fun.

There are games you play with friends or strangers, against strangers, for personal glory.

There are games you play with friends or strangers, against computers, for team achievement.

And there are games you play with friends or strangers, against friends or strangers, with no explicit goal at all.

I don’t have much to say about the first two — there are some great games out there, worth playing.

The last three, however, can teach wisdom you won’t learn at school.

For Personal Glory

Competitive games played for personal glory make all the best esports. Depending on your age, this might include titles like: Quake, Starcraft, Counter Strike, DOTA, Halo, Call of Duty, Gears of War, World of Warcraft (arena), League of Legends, Hearthstone, Overwatch, PUBG, Valorant, and so on.

When you play these games with a competitive mindset, you play to win, and you play against other humans. Humans who also very much want to win.

“For Glory” games have one primary thing to teach: a repeatable process for acquiring new skills, mastering them, and deploying them in the market against other competitors effectively.

You can read Sirlin’s book for free (link) on the important facets of competitive gaming, on fundamentals, on sequencing of fundamentals, on creative remixing of sequences, on vision and reading your opponent.

When you watch an average juggler, most people have a thought in the back of their mind that goes something like:

If I dedicated enough time to it, I could probably learn to juggle about as well as that

But when playing games “For Glory”, your absolute rate of skill acquisition itself is only one part of the problem, most relevant at the very beginning of your journey up the merciless majestic mountain.

Once you’ve mastered the basics, what matters is not just your absolute rate of skill acquisition, but also your relative rate of skill acquisition. No competitive playing field is static. Tactics evolve as players evolve, even at the very highest levels. Meta games are constantly moving. What was considered a mindblowing display of skill at the highest echelons of professional play will, over the years, become a standard part of every competitive player’s arsenal.

Only those who’ve seen that downstream journey of skills play out, from the pros to the masses, can understand how scary it is for every serious competitor. It is not enough to master the basics, you must also master the sum total of all innovation happening in the pro-scene, in real-time, as fast as everyone else is trying to master it. And then develop your own style on top of it all.

The reason to play games “For Glory” to wanton excess is not to become a professional gamer, but to learn the meta-skills of rapid skill acquisition and ruthless self-evaluation. These are incredibly useful in the complex modern world, where self-education is the only kind of education that makes a difference.

These meta-skills aren’t easy to learn, either. If they were, the doors to competitive success would open to anyone who puts the time in, though that time is a necessary prerequisite. There are common psychological barriers that tend to block your progress in the arena. Your own individual mix of culture/personality/discipline/ego will determine how they manifest. One common manifestation is intense competitive anxiety — if you’d like to read more, here’s a 370-post forum thread about the interplay of identity, ego, adrenaline, and expectations, all of which combine to produce one result: you don’t put in the reps.

Or consider how stubborn attachment to habits develops among almost all gamers — you find a sequence that works particularly well for you, you repeat it, you get good results, you repeat it, you get good results…oops. At this point your fundamental improvement loop is completely broken:

You’re not doing something because it’s The Right Thing To Do. You’re just stuck doing it because it worked for you last time. Stop. Go to jail. Do not pass Go! Do not collect $200. You might laugh until you remember the grand tactics of World War I. It’s all fun & games until someone’s OODA loop[1] degenerates into “Decide→Act” on an endless cycle.

At the other end of the spectrum you’re likely to see reactionary competitive-apathy (ego-preservation), “tilt”, defeatism, or any one of a host of psychological stumbling blocks.

If you can become good at these sorts of games, particularly if you can experience “climbing the mountain” in more than one domain and see which lessons are transitive across time and space, you’ll have a skillset that you can take out of the virtual world and plug right into the real one.

For Team Achievement

If you’ve had your fill of glory, there are a small number of games that offer a multiplayer team-oriented goal-based gameplay experience. The most popular of these is — and has been for over 15 years — World of Warcraft (raiding).

Ben Horowitz wrote about the distinction between Peacetime and Wartime CEOs back in 2011.

As he notes in that brief read, the lessons are general leadership lessons — applying to more than just the CEO himself. “For the Achievement” gaming can teach you pretty deep lessons about what successful leadership looks like under extreme adversity.

The nature of wartime means that most conflicts are unique enough that lessons are hard to generalize. For the leader of a serious (raid) team, you might expect your gaming experience to include:

Double-digit team attrition during bad times, single-digit attrition quarterly

Even your best team members will leave for external reasons and not be heard from again

Bad times completely out of your control

E.g. the owners of the game release a major update reducing the strength of your best team members (expect their morale to plummet)

Internet connectivity issues on a ~25 player team will cause mission failure on a weekly basis

Bugs or freaks of programming will cause mission failure on a monthly basis

Bad times completely because of your bad decisions

This bifurcates into i) (clear) bad decisions, which can be learned from and ii) (unclear) bad decisions made under conditions of extreme uncertainty (“fog of war”), which can easily offer no actionable lessons or, worse, lead to a reactionary bias in future decisions that hurts you again in the opposite direction

Nobody will — or can — tell you which category of decision a given bad decision was

Bad times completely a result of individual underperformance

Including by team members you cannot currently afford to replace

Bad times as a result of personality conflicts

Including conflicts among mutually irreplaceable team members

Public and private disagreements with leadership decision making

Well-meaning-but-frustrated team members, particularly if they are talented individuals, are most at risk for developing negative attitudes towards the team, and therefore towards leadership

Public disagreements: you have to parse any genuine actionable feedback out from frustration-tinged disagreements, in real-time, while maintaining the respect of both the individual(s) in question and the broader team

Private disagreements: if you don’t have enough genuine respect from your average team member, they won’t let you know when people start whispering about “weak-links” and stirring the pot in ways that only worsen morale & performance

Disagreements over pay (reward distribution)

The easiest way to solve these is to take less for yourself as a leader — which means your extra work will go unrewarded[2]

The majority of nights to end in mission failure

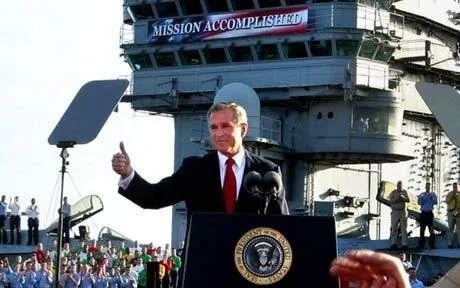

I’m underselling the prolonged state of misery here. If you can make it through all that to the sweet catharsis of “Mission Accomplished” at the end…well. If indeed.

This image is more apt than it first appears…there is no real end to your Mission. The struggle begins again soon after you succeed.

The reality of a goal-based team activity like this is that you are failing every night, until you achieve victory…at which point your goal is accomplished and you switch to a supposedly-chill holding pattern (“Peacetime”). In reality, you’ll be amazed at the sorts of conflicts which find ways to bubble up in “Peacetime” — and even begin to dread the coming mission-completion as you sense it approaching, knowing that the release of tension will lessen the glue holding your team together.

Yes, there are milestones along the way, points you can hold up and say: “Despite not yet achieving the goal, we are currently among the top [X] teams competing!” No, those don’t really matter to anyone at the end of the day and most people on your team knows that in their soul.

Outside of the very best professional or semi-professional-level teams, the “Mission Accomplished” stage for Warcraft takes anywhere from 1 to 12 months to achieve, depending on the quality of the team and the length of time the game developer allows before releasing a new raid.

On average, teams probably spend 3-4 hours a night, 2-3 nights a week, for ~6 months — between 144 and 288 hours (!) — failing to achieve a team-based goal with 19-25 fellow teammates, until eventually succeeding. And then they do it all over again. And again.

There are not many opportunities in life to learn the somewhat unpleasant lessons of leadership-under-adversity. Fewer still of those are as physically & mentally forgiving as ~200 hours sat at your desk in the evenings instead of watching Netflix. Certainly the majority of them come with tangible negative impacts on your real-world physical, mental, and/or financial health when you fail — and you will experience many failures.

In some ways, you’re getting the discount lesson here. But you’ll get more out of it than any management books you can buy.

For Self Discovery (“Playing in the Sandbox”)

This final category of gaming is a hard one to explain. Often described on wikipedia with terms like “sandbox” or “survival” or “persistent world”, the core thrust of these games is to start players at the very bottom of a savage hierarchy…and say: “Go!”

Popular titles in this genre today might include: Eve Online, Rust, Ark: Survival Evolved, and even multiplayer hosted servers of games like Valheim or Minecraft.

The specific takeaways from games like these will be wildly different depending on your own psychology — which is, in fact, the one universal lesson to be learnt: who you are, what you like, how you react to the removal of structure, how you choose relate to others when there are no expectations, and so on.

I can’t speak much more on this category, because the lessons really do not generalize very well at all, beyond a base level of appreciation for the situation of Feudal peasants.

Your experience in these games might mirror a virtual version of any of the above images

The one thing you’ll probably come out of the experience with, no matter how you choose to define yourself in-game, is the radical impossibility of maintaining total safety of yourself and your assets in a predatory world.

How you react to that is up to you, and it’s certainly traumatic the first time you experience an in-game reset back down the hierarchy at the hands of another player. It is not something you can ever experience in a school setting. Teachers, parents, and anyone who cares about your well-being will steer you far, faaaaar away from these sorts of situations.

For myself, some measure of Zen about the whole thing, coupled with preparatory planning for the inevitable total-loss, were valuable takeaways. Personal risk tolerances, how you treat assets, and how you react to acquiring Wealth can’t ever be learned in an environment where you don’t care about said risk/assets/Wealth (i.e. classroom exercises or fake trading simulators).

Sandbox games give you that environment. Nothing you earn or build would have been yours if you didn’t care enough to go out and get/create it — the games don’t push you forward, and they don’t kid you about being able to keep hold of your property forever. There’s always a bigger fish.

Which means that when a bigger fish does come along, you really don’t want to lose your stuff. How to solve that problem is up to you.

Winning Eve: The Real Endgame

It is often said that the only way to “Win at EVE” is to unsubscribe your characters.

You cannot remain at school forever. After graduation, you might still read books, essays, scholarly articles, even dabble in some thesis-generating activity of your own…but you no longer exist within an academic institution.

It is up to you to shift-your focus up from your studies and translate your education to the real world.

There are many pitfalls with “gaming to excess,” not least of which is that you might become consumed by the process…(I promise not to make any comparisons of the form Academic::Gamer as School::Game)

“For Personal Glory:” Revenge of the Ego

When gaming “For Glory”, the important practical lessons are about acquiring new skills, and the important psychological lessons are about overcoming the parts of your ego that hold you back. Sirlin’s metaphor of a “majestic mountain” whose peak you must attempt to climb in order to win is quite apt. But then: where will you look when you have summitted the peak?

The reality of mastering the parts of your ego that tend to inhibit competitive progress is that…you will progress competitively. A polite way of saying: “you will become better than others at the game.”

If you’ve done a good job, you can even drop a word there: “you will become better than others at games.”

You don’t need a PhD in Buddhist philosophy to appreciate how this will tend to feed a very-hungry ego! You probably don’t need me to point out the pressure said ego will exert to drop the final two words from that sentence: “you will become better than others."

Defining your identity by proxy of your performance within a game is unlikely to set you up for success in the real world.

For a mere student, as opposed to an aspiring “pro gamer”, your best bet here is to copy brownbear, linked above, and set yourself specific percentile-ranking brackets as a target — taking a break or stopping altogether after achieving them.

“For Team Achivement:” Inelastic Effort

And the truth is that the energy needed to achieve success in these sorts of domains is somewhat inelastic.

Going through the goal-based team struggle the first time will be a doomed challenge, failure certain unless you’re taken under the wing of an experienced veteran. The second time you might achieve victory. The third time you ought to have it in the bag. The fourth time? The fifth?

Are you having fun?

“We do these things not because they are fun, but because they are steps on the journey.”

The effort to sustain victory over the long-term in team-based goal-oriented games is incredibly taxing. You might begin to sympathize with the affection Cincinnatus felt for his farm.

At the point where you’re no longer learning, the weight of expectations will still press upon you and your team will still need your leadership. It is up to each leader to learn where their breaking point is, and to do right by the team they’ve built while navigating the closing of their leadership — either by passing the mantle or closing the doors.

Your personal energy is finite, after all, and the inelasticity of the effort needed to unite, motivate, and push a ~25 person team to repeated success will leave room for little else. Sometimes small things really do take as much energy as big things.

“For Self-Discovery”: Discover Your Own Pitfalls

The downsides of excessive sandbox-play will be up to the reader to determine, based on their own experience. I would never rob anyone of self-discovery, even the painful parts.

Generational Divides Beyond Gaming: A Deeper Conclusion Than You Were Expecting

Games are best played to excess in order to learn things you won’t learn in school or early in your career

I have no doubt that millions of Chinese youths will find a way around restrictions imposed by Xi Jinping & co.

To the extent that people object to gaming in the mass media — and state-sponsored bans for minors are certainly an objection — the concern usually relates to children, how much time they waste, what lessons they learn, how much violence they mimic, how they learn to relate to each other, etc. etc.

Generational divides are some of the hardest for any society to navigate, and China’s jaw-dropping economic & technological advances over the last few decades often overshadow the very real history still remembered by its leaders today. Xi Jinping’s “Early Life” section on Wikipedia is harrowing. The Cultural Revolution was contemporaneous with the Summer of Love in the USA. Our generational divides are not in the same solar system.

In one of his more controversial essays on Why Nerds are Unpopular, Paul Graham at least identifies a thorny problem for modernity:

Teenage kids used to have a more active role in society. In pre-industrial times, they were all apprentices of one sort or another, whether in shops or on farms or even on warships. They weren't left to create their own societies. They were junior members of adult societies.

…Teenagers now are useless, except as cheap labor in industries like fast food, which evolved to exploit precisely this fact…

…In my high school French class we were supposed to read Hugo's Les Miserables. I don't think any of us knew French well enough to make our way through this enormous book. Like the rest of the class, I just skimmed the Cliff's Notes. When we were given a test on the book, I noticed that the questions sounded odd. They were full of long words that our teacher wouldn't have used. Where had these questions come from? From the Cliff's Notes, it turned out. The teacher was using them too. We were all just pretending.

There are in fact rigorous schools still out there, where the academic exercises are not quite so pretend. But even when executed properly, schooling is not reality, nor is reality much like school. Some forms of education cannot occur in the classroom. Students at all ranges of academic aptitude often recognize this early on.

For sure, the vast majority of gaming that teenagers engage in is done for the same reason teenagers do anything: because they want to. I wasn’t scouring MLG forums and arenajunkies in high school because I wanted to learn meta-skills that would help my career. I just wanted to win.

Nonetheless, hobbies and habits picked up in young-adulthood often stick around. The lessons gaming has to teach you aren’t going anywhere.

You can condemn gaming for being psychologically exploitative and look down on the kids for spending too much of their time in make-believe contests. Those are fair criticisms.

But you ought to judge still more harshly the surrounding society that removes many avenues for the kinds of personal growth that gaming creates. A society that never hands any real responsibility to its future generations, and that delays the transition as long as it can:

It’s for the best that these important lessons are learned by the next generation. Traditional sports will provide some of these lessons for many kids[3] — and the focus on athletic events at most top-tier schools & colleges is downstream of that realization. But sports don’t work for everyone, and per my note [3], they mostly fail to set up a framework to learn the lessons I’ve laid out above. The temptation for coaches and parents to intercede is too strong.

For those who feel they might have something still to learn, I recommend Gaming.

What’s the worst that could happen?

Notes, Critiques, and Responses

[0] Last week, really, but I banged this out on Sunday and I’m not changing it now

[1] If you can understand & relate to this paragraph from the very first page, then you’re 90% of the way there on the path “For Glory” —

[2] You’re in good company here though:

What then have I reserved to myself after all these labors, except this purple robe and this diadem? I have appropriated nothing myself, nor can any one point out my treasures, except these possessions of yours or the things which I am guarding on your behalf.

[3] Some of my strongest childhood memories are from sporting events. I was part of a national-championship-winning team at age 11 and a regional-championship-winning team at age 13, long before I had an internet connection good enough to play with and against other people on the internet. I also got to be being a team captain of 2 sports teams in England — a wonderfully educational experience, and one that not a single American child gets to enjoy.

British readers will be horrified to learn that most American sports captains are “elected” democratically by their fellow students…and have no meaningful impact on the game itself. The coach makes all important decisions from the sidelines. Student responsibility is abstracted away, and therefore the lessons learned are quite different.

American readers will be baffled at my comments here. The idea of a collective popularity contest for a largely-ceremonial prize with negligible genuine responsibility is a deeply American one. Don’t @ me <3

[98] This leaked communiqué describing Xi Jinping’s political aspirations, courtesy of a childhood friend and/or the National Security Council, is fascinating to read — most especially in the full context of the harrowing childhood experiences that Xi & his family endured. Thanks to N.S. Lyons of The Upheaval for introducing me to it.

I also liked Goethe in China by Edward Luttwak a lot.

[99] One response to some of this essay might be something like:

Why don’t you take all that energy and spend it on entrepreneurship or aid work instead? Surely you can learn the same lessons AND effect change in the real-world!

For some people, this is perhaps true. I hate to over-quote Paul Graham here, but unfortunately much of his early writing is just full of too much wisdom to ignore. In this case, the most-likely outcome is “playing house” AND failing to learn the underlying lessons & small-wisdoms that come from leadership:

Gaming might be fake, in so far as it’s virtual. But within the constraints of the virtual world, the problems CANNOT be faked or abstracted or privileged-access’d or made to sound meaningful for stakeholders in a pretty slide deck. Thus, even though the output will be mere pixels on a screen, the process to get that output must be true, meant in the fullest sense of the word “true”.

There are rare cases of super-genius teenagers being perfectly placed at the nexus of technological change and social development, such that they make the perfect founders. If you’re planning to start the next big social media startup, you might consider ignoring this essay. But there are many great institutions that require technical skills, work experience, personal networks, a track record, and access to capital that you won’t have until your mid-late 20s, at best.

Power and responsibility move together, and neither have been given very freely to the newer generations. When that time does come, at last, the millennial generation will find itself lacking without some avenue to acquire the skills & wisdom necessary for a bright future under their stewardship.